The Optimist – not and easy state of mind in Zimbabwe these days

Slowly and surely the US dollar is creeping back. It’s perfectly legal, as is the local Zimbabwe dollar, but it’s getting increasingly rare to be quoted prices in them. Even the road tolls, which were always quoted in local dollars, have now stated that prices will be in US dollars though one is welcome to pay in Zimbabwe dollars at the official exchange rate. The road tolls are set by a government body.

Fuel stations are more blunt; only US dollars are acceptable and if paying by a foreign currency bank account you have to be prepared to wait whilst it’s ascertained that it really is real dollars you are using.

A visit to Kaguvi Street in the city area known as “the cow’s guts” (it’s filthy, raucous and vibrant) to source a car part was enlightening. I was offered the piece of radiator hose – not the correct one but with a bit of cutting it would do – and told it was $12 and did I have the exact amount? No, I didn’t but suggested I could use my local debit card for the equivalent of $2. Nobody had suggested that I could pay in local currency even though the debit card machine was in full view.

A couple of uniformed police walked into my office a few weeks ago. They were very polite as befitting the public relations department. My first reaction was that I’d be in trouble for not wearing my mask, even though there was nobody else around. It’s required under Zimbabwe law that a face mask is to be worn anywhere outside the home, including your own car even if you are alone. But they weren’t interested in that. They were after donations in cash or kind for building an office at the Borrowdale (my “local”) police station. I was dumbfounded. I was not surprised that they wanted to replace the ramshackle office that they currently use – it’s very temporary and probably wouldn’t last another rainy season. I asked if they’d approached the “powers that be” for funding. They had and had been told to go out and approach the community. I gave them my usual rant that I already paid tax to this government so why should I pay again? They shrugged and looked embarrassed and asked again if I could give them anything, anything at all would be appreciated.

I asked if they knew what it would cost. An architectural plan and a budget spreadsheet were offered. It all looked professionally done and of course the budget was in US dollars. The total was around $14,000 which I thought was quite a lot for what was being planned but they assured me that they’d got the required three quotes. I wondered to myself whose relative had won the contract but decided to keep quiet. I said I’d think about it and promised to get back to them.

I didn’t have to call back as the next morning they phoned me. I said I’d get them five pockets of cement – one of the perks of a farming company is that just about anything can be put through the books so the aforementioned cement could be listed as an expense and come off my tax bill. What would I get out of it? The police at that station would owe me a favour and that, dear readers, is how Africa functions. Indeed, in the past I’ve got off a traffic speeding fine because the enforcing officer used to get cheap meat from the farm where I lived.

Later the following week when I dropped off the cement some off-duty policemen in plain clothes unloaded the pockets from my truck. I’d witnessed them negotiating some after-hours guarding work with an Indian gentlemen. All the figures were of course in US dollars. I didn’t ask what their government salaries were or what the currency was – stupid question really as it was plainly not enough to get by.

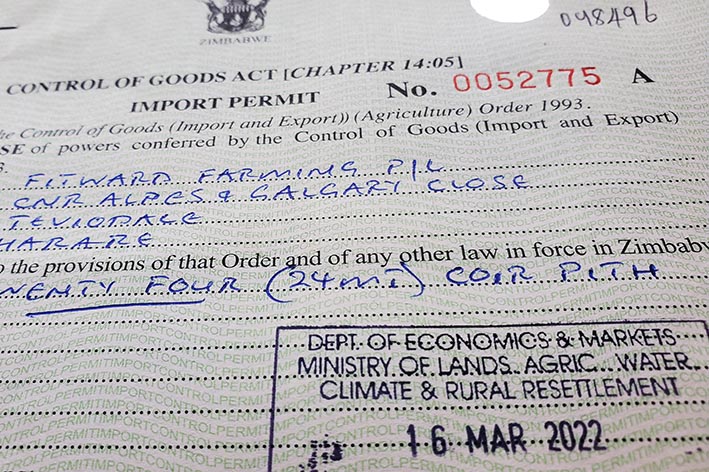

A few local stores still quote in local dollars but they are getting few and far between. Where possible I pay in the local money as the majority of my income is in that currency. Customers do pay in US cash (the local cash notes are as rare as they are useless – the biggest note is ZW$50 which is about US50c) so I hoard it to pay at least part of the wages bill. My company also has a US dollar account that I use for importing raw material. One customer does pay me this way and last week I received about $24,000 for a big gum tree seedling contract that I completed last year. The gum trees will eventually be harvested and used to cure tobacco so the initiative is funded by a levy on tobacco sales which is paid in real US dollars. Hence the fact that it can be used to import materials.

I noticed on Monday that the figure in the nostro account, as the US dollar accounts are known, had been reduced by some 20%. At first I suspected there had been a mistake and somehow the depositor had withdrawn the excess. I decided to ask my bookkeeper who is knowledgeable in these sort of things. “Oh no”, she laughed, “the Reserve Bank have taken 20 percent and given it back to you as local currency. Check your other account”. I couldn’t believe what I was hearing but sure enough, when I checked, there was the money deposited in my Zimbabwe dollar account at the official rate which is some 30% lower than the black market rate. Once again, the government is stealing our hard currency.

Still seething the next day, I mentioned this to my neighbour at work. She was not surprised. Her son is an export agent for fresh produce into Europe and the UK – the Reserve Bank takes 40% out of his account and pays him back in local currency. This is especially problematic as he has to book and pay airfreight in advance and they don’t want Zimbabwe dollars.

At the end of every year, along with various tax obligations, we have to provide to the local tax authority a comprehensive list of income, tax paid, allowances and bonuses of all employees who have paid tax over the course of the year. This is purely a fact gathering exercise – it has no bearing on the tax bill – but if submitted late one can garner a heavy fine.

I haven’t up until now bothered with a specific wages software package as most of the time I employ 17 permanent staff and an Excel spreadsheet copes just fine. Income tax is calculated and paid on a monthly basis using a system known as PAYE (pay as you earn) and whilst a bit tedious there were only a few people paying tax. However, in 2020 the inflation has run well ahead of the PAYE tax tables and lots of people ended up paying tax who were earning less than USD2 a day equivalent in the local currency. This meant two weeks of sifting through spreadsheets and collating tables and filling in the required ITF16 form. This is not going to happen again so I’ve spent the last 6 weeks writing my own wages software package that will do all that with just a few mouse clicks. Writing the software that does the PAYE was enlightening. No surprise that not only is there a local currency table but there’s also a US dollar table! The tax threshold starts at $2.31 per day with a tax of 20% (less a 46c deduction). If you don’t believe me look here.

“The term “absolute poverty” is also sometimes used as a synonym for extreme poverty. Absolute poverty is the absence of enough resources to secure basic life necessities.

To assist in measuring this, the World Bank has a daily per capita international poverty line (IPL), a global absolute minimum, of $1.90 a day as of October 2015.”

Using the above definition (from Wikipedia), and it is a little dated, it might be fair to say that Zimbabweans start being taxed when they are not quite extremely poor. That’s how desperate our government is.

Of course it needn’t be like this. A report from the Daily Maverick newspaper in South Africa is particularly damning.

“The report focuses on business cartels because these are the vehicles used for state capture. One of the experts we asked to review the report pointed out that normally cartels work to undermine the state. In Zimbabwe, however, they are in league with the highest people in the land. #DemLoot, in the now-famous words of journalist Hopewell Chin’ono.” The Daily Maverick

Last week I was chatting to a customer who was looking for advice on what crops he could grow. I gave him my standard spiel on finding a market first and then approaching me. Then I asked him what he’d been doing. “I’ve been in Afghanistan for the past 15 years and I’m tired” he replied. I wished him the best of luck.

Taxed if you do, taxed if you don’t

26 08 2023It had to be a mistake, I couldn’t possibly owe the tax department (ZIMRA – Zimbabwe Revenue Authority) that amount. Even if I converted it to US dollars it would amount to an impossible figure – about 17,500 at the unofficial rate and 23,000 at the bank rate. I checked the email address – it was from a person with whom I’ve corresponded over the years. Then there was the wording; FINAL DEMAND. Where were the other demands? I did what any sensible person would have done and contacted my bookkeeper in a state of panic.

Alison was more than a bit puzzled but told me she couldn’t do anything without seeing how they’d got the figures. “Your are entitled to see what’s going on” she said. “Ask them for the ledger”

The ledger was duly sent and the waters immediately became a lot murkier. It stated the figures were in US dollars and the numbers, if the currency was US dollars, were impossible. I sent it on to Alison. It was a while before she came back to me by which time my imagination had run riot. What if I really did owe 105 million dollars? I would have to buy it on the open market with my US dollars and would be left with no operating capital and nothing with which to pay wages. The company would be unlikely to survive.

Alison assured me that the figures on the ledger were Zimbabwe dollars and I probably did owe the 3,835,807 listed. She had no idea where the 105 million came from. “Ask them” she said. So I did.

The reply was abrupt; the 105 million was to be ignored (RTGS is another way of saying Zimbabwe dollars). The amount on the ledger was also incorrect as it didn’t account for some US$550 that I’d paid in presumptive tax (they are called Quarterly Payment Due or just QPD) which would have reduced the amount owed close to zero.

I speculated to Marianne that it was all just a bit of psychological bullying to get me to pay attention to the outstanding amount, then two days ago I bumped into Gary whose wife had had a strikingly similar experience.

Gary works for a seed company that occasionally uses my nursery to grow seedlings for various trials. They have a trial on ART Farm which is a neighbour to my nursery and I sometimes use it access my nursery so as to avoid the appalling direct road and take in a bit of soothing farm scenery on the way. Gary was having a look at one of their trials near the road so I stopped to chat.

We discussed various things then I related my experience with the tax authority. He said that Clare, his wife who works as a bookkeeper for a local church, had received a final letter of demand for payment from ZIMRA for an impossible amount about three months ago. She replied that as a church they were not liable for tax and any money made was given away to various charities and nothing more was heard. He agreed with me that as the government was desperate for money it was likely endorsing ZIMRA’s intimidation tactics to get in whatever money they could, maybe they were even giving a commission.

On getting to work I related the story to my senior foremen. They were decidedly cynical. “They are all on the take” opined Chingedzerai. “Yes”, added Fabian, “they see the rest of the government officials stealing and think that they should have some of the pie too. They see what they can bully you into paying and then split the extra between themselves”. It was obvious that they thought I was being naïve.

Marianne had been doing some questioning of her own and posted my problem on the local community WhatsApp group. Someone had responded with a name and phone number of a senior official at ZIMRA whom he thought would be able to help. I gave him a call and related my problem and asked if it was official ZIMRA policy to send out threatening demands based on nothing much at all. His indifference was striking; I should send him a copy of all the correspondence and documents and he’d forward it to the relevant manager. I duly sent him the copies but I am not expecting a reply.

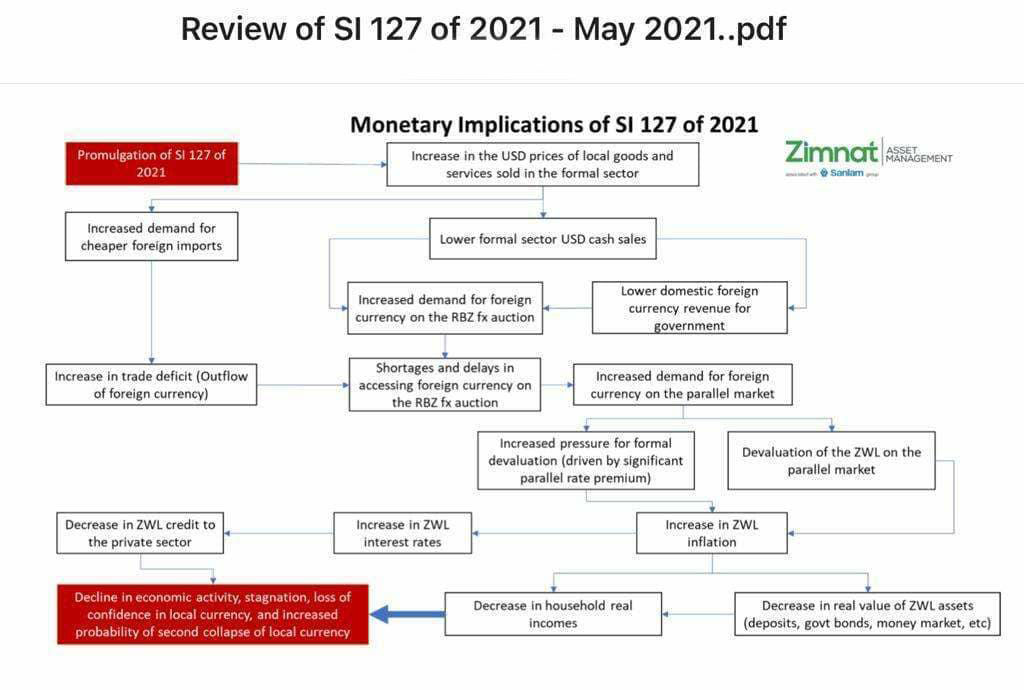

It’s no secret that Zimbabwe is in deep financial trouble. Mismanagement, corruption and incompetence have seen our GDP plunge after the Mnangagwa government took power in a coup back in 2017.

At the time it was welcomed by the majority of the population who were relieved to be rid of the much hated and feared Mugabe regime but it was not long before the new government of E D Mnangagwa revealed its true colours of repression and corruption. Chingedzerai reminded me that the current administration has never bothered to investigate the estimated US$15 billion worth of diamonds that went unaccounted for from the Chiadzwa diamond fields in the east of the country in the latter part of the Mugabe era. More recently there was the gold smuggling exposé by al Jazeera that showed how top Zimbabwean officials were, with the highest approval, smuggling gold out of Zimbabwe and laundering the resulting cash. Indeed, for a country that is struggling financially, there is an eye-opening amount of property development around town. In the past this would have attracted the attention of ZIMRA who would have demanded to see the accounts of owners of expensive properties and made to account for the development. Now it’s easier, and more personally profitable, to send out threatening letters.

I paid wages on Tuesday. We chose the date years ago when getting cash from the bank at the end of the month meant enduring long queues and not getting the desired breakdown. Chingedzerai had heard the income tax limits had been increased and asked me to check on the internet before he entered the attendance and overtime figures on the computer. I was fairly sure it was only the Zimbabwe dollar tables that had changed but checked on the US dollar tables anyway (I have been paying my staff in the latter currency since August last year).

In Zimbabwe salaries are taxed monthly and the system is known by its acronym PAYE; Pay As You Earn. The rates are iniquitous. Wages are taxed from US$100 per month upwards! Given that the minimum agricultural wage starts at US$60 before any of the required allowances, most of my staff are taxed. Some do get age exemptions but the rest of them have to endure.

Such is the government’s demand for money that it has taken to taxing money transfers at 2% per transfer. It goes without saying that most transactions are cash though it’s not always possible. The government used to tax cash withdrawals from banks but gave up when it became evident that people were simply not depositing cash in order to avoid paying the tax.

Given the high cost of living and taxation in Zimbabwe one would assume that the majority of the population would be keen for a change of government. Indeed, given that we had a general and presidential election on Wednesday, one could be forgiven for thinking it imminent. With the recent exception of Zambia, southern African is not known for changing its governments and Zimbabwe is not about to become an exception too.

My foremen and I were all in agreement on this; the incumbent ZANU-PF party, which has maintained its grip on power since 1980 by means mostly foul, will certainly cheat its way to victory; only the level of the fiddle is not known. So far it’s been “limited” to delaying delivering voting papers to polling stations in regions known to be opposition strongholds, sending voters to polling stations where they found they weren’t registered, making sure one couldn’t check the online registration database and of course blatant intimidation. Few, if any, believe the logistical problems to be anything but deliberate. We remain cynical.

Comments : 2 Comments »

Tags: corruption, general election, tax, ZIMRA

Categories : Blogroll, Economics, Social commentary